PROPOSAL TWO: APPROVAL OF

AMENDMENT TO 1994 EMPLOYEE STOCKPURCHASE PLAN

NI is asking its stockholders to approve a proposed amendment to its 1994 Employee Stock Purchase Plan (the “ESPP”) to increase the number of shares of common stock reserved for issuance thereunder by 3,000,000 shares. On January 23, 2019, the Board of Directors approved the addition of 3,000,000 shares to the ESPP, subject to approval by the stockholders.

The ESPP is intended to promote the best interests of NI and its stockholders by providing eligible employees with the opportunity to become stockholders by purchasing NI common stock through payroll deductions. NI’s Board of Directors believes that the ESPP encourages employees to remain employed with NI and aligns the collective interests of NI’s employees with those of NI’s stockholders. NI’s continued success depends upon its ability to attract and retain talented employees. Equity incentives are necessary for NI to remain competitive in the marketplace for qualified personnel, and an employee stock purchase plan is a key element of NI’s equity incentive package.

As of March 15, 2019, 19,951,316 shares have been issued since the adoption of the ESPP and 1,749,934 shares remained available for issuance. Assuming approval of the amendment to the ESPP at the Annual Meeting, the total number of shares remaining available to be issued under the ESPP would be 4,749,934 shares. Based on current and projected usage, we currently expect that the increased share reserve would meet the anticipated needs under the ESPP for a period of approximately three years.

Based on the number of shares issued under the ESPP during recent offering periods, the Board of Directors believes that the shares remaining in the ESPP may be insufficient to meet the estimated participation levels for upcoming offering periods unless more shares are added to the ESPP. Also, it is critical that the ESPP have sufficient shares at the start of each three-month period to meet the purchase requirements of the entire three-month period in order to avoid potential adverse accounting consequences and allow the ESPP program to continue uninterrupted.

The following summary of the principal terms of the ESPP is qualified in its entirety by reference to the full text of the plan which is attached hereto as Exhibit A.

Purpose. The purpose of the ESPP is to provide a method whereby employees of NI and certain of its subsidiary corporations will have an opportunity to acquire a proprietary interest in NI through the purchase of shares of NI common stock. The ESPP is intended to qualify as an employee stock purchase plan under Section 423 of the Code (“Section 423”). In addition, the ESPP authorizes the grant of options that do not qualify under Section 423 (the“Non-423 Component” of the ESPP) pursuant to rules, procedures orsub-plans adopted by NI’s Board of Directors that are designed to achieve desired tax or other objectives in particular locations outside the U.S.

General. The ESPP is implemented by successive three-month offering periods, subject to Administrator (as defined below) discretion to implement separate offerings for employees outside the U.S. The ESPP operates by eligible employees electing to have a portion of their regular compensation deducted from each paycheck. The payroll deductions are accumulated over each period of approximately three months known as an “offering period.” On the first business day after the end of each offering period, accumulated payroll deductions are automatically used to purchase shares of NI’s common stock. The purchase price for the shares is equal to the lower of (a) 85% of the fair market value (as defined in the ESPP) of the common stock on the date of commencement of the three-month offering period or (b) 85% of the fair market value of the common stock on the last day of the offering period. The fair market value of the common stock on a given date will be determined by the Administrator in a manner consistent with the ESPP and the Code. The closing price per share of NI common stock on the Record Date was $45.16.

Administration. The ESPP may be administered by the Board of Directors or a committee of the Board of Directors. The ESPP is presently being administered by the Compensation Committee. The term “Administrator” means whichever of the Board or the Compensation Committee is then administering the ESPP. All questions of interpretation of the ESPP are determined by the Administrator, whose decisions are final and binding upon all participants. Subject to the express provisions of the ESPP, the Administrator has discretion to interpret and construe any and all provisions of the ESPP, to adopt rules and regulations for administering the ESPP, and to make all other determinations deemed necessary or advisable for administering the ESPP, including designating separate offerings under the ESPP and designating whether designated subsidiaries (as defined below) participate in the portion of the ESPP designed to qualify under Section 423 or the portion of the ESPP that is not designed to qualify under Section 423. The Administrator is specifically authorized to adopt rules, procedures, andsub-plans, which for purposes of theNon-423 Component of the ESPP may be outside of the scope of Section 423, including, but not limited to, eligibility to participate, what earnings may be included in contributions, modification of offering periods, handling of payroll deductions, making contributions to the ESPP, and obligations to pay payroll tax.

Eligibility. Employees are eligible to participate in the ESPP if they are regular employees of NI or a designated subsidiary, as defined below, scheduled to work at least twenty (20) hours per week (or a lesser number amount as required by applicable law or as established by the Administrator with respect to separate offerings outside the U.S.), have been an employee for at least one day prior to an offering period and are not scheduled to work less than five (5) months in a calendar year (or a lesser amount as required by applicable local law or as established by the Administrator with respect to separate offerings outside the U.S.). A “designated subsidiary” is a subsidiary which has been designated from time to time by the Administrator in its sole discretion as eligible to participate in the ESPP. As of January 31, 2019, the closing date of the last offering period, 6,666 employees were eligible to participate in the ESPP, and 3,362 of these employees were participants.

Payment of Purchase Price; Payroll Deductions. The purchase price of the shares is accumulated by payroll deductions during the offering period. The deductions may not exceed 15% of a participant’s gross earnings, which is defined in the ESPP to include the regular straight-time earnings of the participant (plus such employee’s sales commissions, if applicable), but exclusive of any payments for overtime, bonuses, special payments, other incentive compensation and any automobile or expense allowance or reimbursement.

A participant may discontinue his or her participation in the ESPP at any time during an offering period. Payroll deductions commence on the first payday following the offering date, and continue at the same rate until the end of the offering period unless a participant withdraws from participation in the ESPP.

Changes in Participation Levels. A participant’s level of payroll deduction with respect to an offering period is initially set by the participant completing, signing and submitting a subscription agreement specifying the rate of payroll deduction up to 15% of the employee’s gross earnings. A subscription agreement shall remain in effect for successive offering periods unless (i) a new subscription agreement is completed, signed and submitted during the enrollment period for a future offering period or (ii) a participant withdraws from participation in the ESPP. Unless the Administrator determines otherwise, a participant’s payroll deduction level may not be changed for a particular offering period once that offering period has commenced. The level can be changed for future offering periods by completing, signing and submitting a new subscription agreement during the enrollment period for the first such future offering period for which the revised payroll deduction rate is intended to apply.

Purchase of Stock; Exercise of Option. The maximum number of shares placed under option for a participant in an offering period is equal to the number determined by dividing the amount of the

participant’s total payroll deductions to be accumulated during the offering period by the purchase price per share, as determined in the manner described above. Unless a participant withdraws from the ESPP, such participant’s option for the purchase of shares will be exercised automatically at the end of the offering period for up to the maximum number of shares, as described below, at the purchase price.

Notwithstanding the foregoing, no participant will be permitted to subscribe for shares under the ESPP if immediately after the grant of the option, such participant would own stock and/or hold outstanding options to purchase stock possessing 5% or more of the total combined voting power or value of all classes of stock of NI, nor shall any participant be granted an option which would permit the employee to buy more than $25,000 worth of common stock (based on the fair market value of the common stock at the time the right is granted) in any calendar year pursuant to the ESPP.

Withdrawal. A participant’s interest in a given offering may be terminated in whole, but not in part, by signing and delivering to NI a notice of withdrawal from the ESPP. Such withdrawal may be elected at any time prior to the end of the applicable offering period. Any withdrawal by the participant of accumulated payroll deductions for a given offering automatically terminates the participant’s interest in that offering. If a participant continues to be employed by a subsidiary of NI following termination of employment with NI or a designated subsidiary such participant will not be deemed to have withdrawn, although the participant will not be allowed to continue making contributions during the applicable offering period or be eligible to participate in the ESPP in any subsequent offering period unless the applicable subsidiary is a designated subsidiary.

Termination of Employment. Upon a termination of a participant’s employment with NI or designated subsidiary for any reason, including retirement or death, or a continuation of a leave of absence for a period beyond three (3) months or, if applicable, such later day as of which such person’s reemployment is guaranteed by contract or statute and referred to as the “guaranteed reemployment date,” such participant’s participation in the ESPP will terminate and all funds accumulated in the participant’s account will be returned to him or her or, in the case of death, to the person or persons entitled to such funds.

Adjustment Upon Changes in Capitalization. In the event any change is made in NI’s capitalization, such as a stock split or stock dividend, which results in an increase or decrease in the number of outstanding shares of common stock, appropriate adjustments will be made by the Board to the number of shares subject to purchase under the ESPP and to the purchase price per share.

Amendment and Termination of the Plan. The Board may at any time amend or terminate the ESPP, except that no such amendment or termination shall affect options previously granted if it would adversely affect the rights of any participant. In addition, no amendment may be made to the ESPP without the prior approval of the holders of a majority of the shares of NI common stock then issued and outstanding and entitled to vote if such amendment would increase or decrease the number of shares reserved under the ESPP, materially modify the eligibility requirements of the ESPP or materially increase the benefits which may accrue under the ESPP.

Federal Tax Information for ESPP. The ESPP and the right of participants to make purchases thereunder, is intended to qualify for treatment under the provisions of Code Sections 421 and 423. As mentioned in thePurpose and Administration sections above, the ESPP has aNon-423 Component, which authorizes the grant of options that do not qualify under Section 423. The following discussion regarding federal tax information applies to options intended to qualify under Section 423. Under these provisions, no income will be taxable to a participant until the shares purchased under the ESPP are sold or otherwise disposed of. Upon sale or other disposition of the shares, the participant will generally be subject to tax and the amount of the tax will depend upon the holding period. If the shares are sold or otherwise disposed of more than two years from the date of the option grant and more than one year

from the applicable purchase date, then the participant generally will recognize ordinary income measured as the lesser of

the excess of the fair market value of the shares at the time of such sale or disposition over the purchase price, or

an amount equal to 15% of the fair market value of the shares as of the date of the option grant. Any additional gain should be treated as long-term capital gain.

If the shares are sold or otherwise disposed of before the expiration of this holding period, the participant will recognize ordinary income generally measured as the excess of the fair market value of the shares on the date the shares are purchased over the purchase price. Any additional gain or loss on such sale or disposition will be long-term or short-term capital gain or loss, depending on the holding period.

NI is not entitled to a deduction for amounts taxed as ordinary income or capital gain to a participant except to the extent ordinary income is recognized by a participant upon a sale or disposition of shares prior to the expiration of the holding period(s) described above. In all other cases, no deduction is allowed to NI.

The foregoing discussion is not intended to cover all tax consequences of participation in the ESPP. The tax consequences outlined above apply only with respect to an employee whose income is subject to United States federal income tax during the period beginning with the grant of an option and ending with the disposition of the common stock acquired through the exercise of the option. Different or additional rules may apply to individuals who are subject to income tax in a foreign jurisdiction and/or are subject to state/local income tax in the United States.

ESPP Benefits. Participation in the ESPP is voluntary. Because benefits under the ESPP depend on eligible employees’ elections to participate and the fair market value of NI common stock on various future dates, NI is unable to predict the amount of benefits that will be received by or allocated to any particular participant under the ESPP. The following table sets forth the dollar amount and the number of shares purchased under the ESPP during the last fiscal year to (i) each of NI’s Named Executive Officers, (ii) all executive officers as a group, (iii) allnon-employee directors as a group and (iv) all employees other than executive officers as a group.

ESPP BENEFITS TABLE

| | | | | | | | | | |

| Named Executive Officer or Group | | Number of

Shares (1) | | Value of

Shares (2) |

Alexander M. Davern | | | | 546 | | | | | $ 26,461.79 | |

| | |

Eric H. Starkloff | | | | 527 | | | | | $ 23,914.00 | |

| | |

Karen M. Rapp | | | | 367 | | | | | $ 18,327.98 | |

| | |

Scott A. Rust | | | | 545 | | | | | $ 24,379.78 | |

| | |

John C. Roiko | | | | 552 | | | | | $ 24,789.53 | |

| | |

All executive officers as a group (5 persons) | | | | 2,537 | | | | | $ 117,873.08 | |

| | |

Allnon-employee directors as a group (5 persons) (3) | | | | — | | | | | — | |

| | |

All employees other than executive officers | | | | 870,316 | | | | | $39,820,571.63 | |

(1) | As of December 31, 2018.

|

(2) | The dollar value of shares purchased under the ESPP was computed by multiplying the number of shares purchased times the market price of the common stock at the close of trading on the trading date immediately preceding the purchase date. In accordance with the terms of the ESPP, the shares of common stock were purchased at a price equal to 85% of the lesser of the fair market value of

|

| the common stock on the first day of the offering period or the last day of the purchase period. The purchases set forth in the above table complied with the $25,000 limitation under the ESPP as such limit is based on the fair market value of the common stock at the time the right to purchase is granted. |

(3) | Non-employee directors are not eligible to participate in the ESPP.

|

NI’s executive officers have an interest in this proposal as they may purchase shares under the ESPP.

Vote Required; Recommendation of Board of Directors

The affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting will be required to approve the amendment of the ESPP. The Board of Directors has not determined what action it will take if the proposal is not approved by the stockholders.

The Board of Directors unanimously recommends a vote “FOR” the approval of the amendment of the 1994 Employee Stock Purchase Plan.

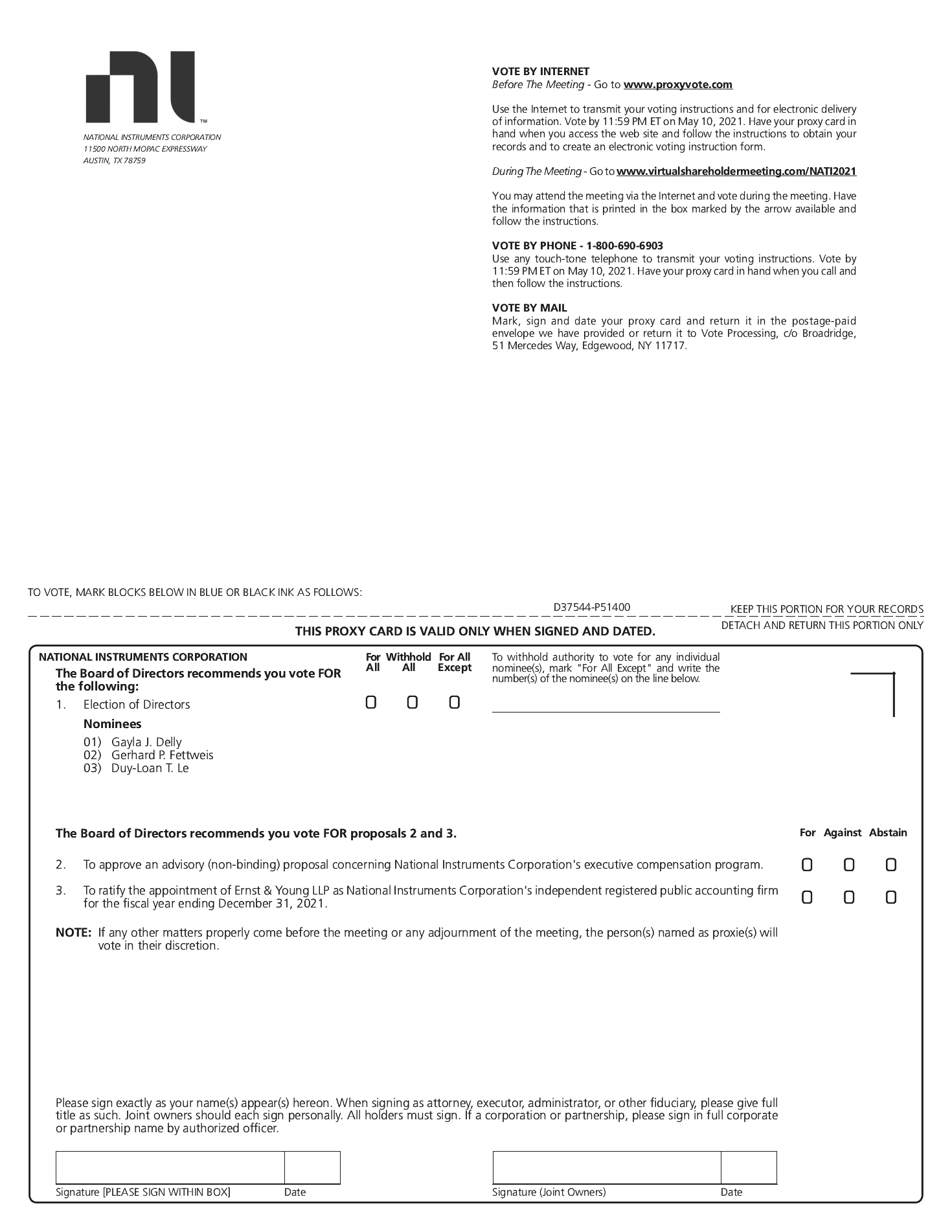

PROPOSAL THREE: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The charter of our Audit Committee provides that the Audit Committee shall appoint, compensate, retain and oversee NI’s independent registered public accounting firm. The Audit Committee has selected Ernst & Young LLP (“E&Y”) as NI’s independent registered public accounting firm for the fiscal year ending December 31, 2019. The Board of Directors is asking the stockholders to ratify this appointment. The affirmative vote of a majority of the shares represented and voting at the Annual Meeting is required to ratify the selection of E&Y, which has served as NI’s independent registered public accounting firm since June 2005.

In the event the stockholders fail to ratify the appointment, our Audit Committee will reconsider its selection. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee believes that such a change would be in the best interests of NI and NI’s stockholders.

A representative of E&Y is expected to be available at the Annual Meeting to make a statement if such representative desires to do so and to respond to appropriate questions.

Audit Fees

The aggregate fees billed for professional services rendered for the integrated audits of NI’s annual financial statements for the fiscal years ended December 31, 2018 and 2017, for the reviews of the financial statements included in NI’s Quarterly Reports on Form10-Q for those fiscal years, for the audit of NI’s internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 for those fiscal years, and for statutory audits in various countries were approximately $1,883,000 and $1,484,000, respectively.

Audit-Related Fees

There were no fees billed for audit-related services in 2018 or 2017.

Tax Fees

The aggregate fees billed for professional tax services rendered for 2018 and 2017 were approximately $440,000 and $289,000, respectively. Included in the foregoing tax fees are such services as tax compliance, tax advice and tax planning.

All Other Fees

There were no fees billed for other services in 2018 or 2017.

Audit CommitteePre-Approval of Audit and PermissibleNon-Audit Services of Independent Auditors

The Audit Committee’s policy is topre-approve all services provided by NI’s independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. The Audit Committee may alsopre-approve particular services on acase-by-case basis. The independent registered public accounting firm is required to periodically report to the Audit Committee regarding the extent of services provided by such firm in accordance with suchpre-approval. The Audit Committee may also delegatepre-approval authority to one of its members. Such member(s) must report any decisions to the Audit Committee at the next scheduled meeting. During 2018, the Audit Committee approved in advance all audit, audit-related, and tax services to be provided by E&Y. E&Y has not performed any “prohibited activities” as such term is defined in Section 201 of the Sarbanes Oxley Act of 2002.

Vote Required; Recommendation of Board of Directors

The affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting is required to ratify the selection of E&Y as NI’s independent registered public accounting firm.

Upon the recommendation of the Audit Committee, the Board of Directors unanimously recommends a vote “FOR” the ratification of the Appointment of E&Y as NI’s Independent Registered Public Accounting Firm.

PROPOSAL FOUR: APPROVAL OF EXECUTIVE COMPENSATION

The Dodd-Frank Act enables our stockholders to vote to approve, on an advisory

(non-binding) basis,

pursuant to Section 14A of the Exchange Act, the compensation of our Named Executive Officers as disclosed in this Proxy Statement in accordance with the SEC’s rules (commonly referred to as a

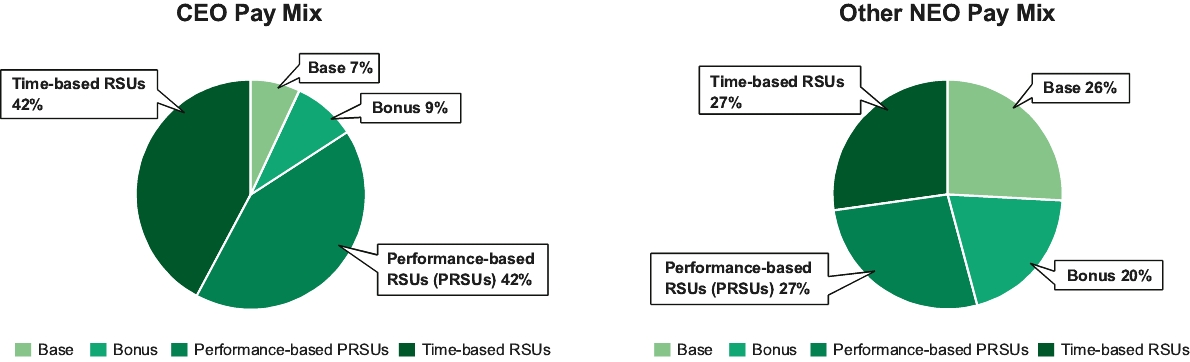

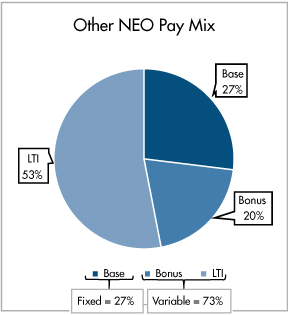

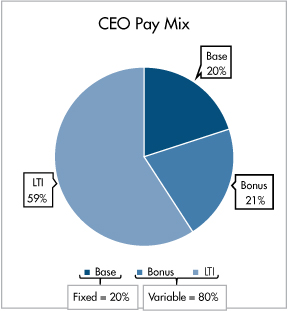

“Say-on-Pay” “Say-on-Pay”).As described under the heading “Executive

Compensation—Compensation — Compensation Discussion and Analysis,” our executive compensation programs are designed to attract, retain and motivate our Named Executive Officers, who are critical to our success. We believe that the various elements of our executive compensation program work together to promote our goal of ensuring that total compensation should be related to both NI’s performance and individual performance.

Stockholders are urged to read the “Executive

Compensation—Compensation — Compensation Discussion and Analysis” section of this Proxy Statement, which discusses how our executive compensation policies implement our compensation philosophy, and the “Executive

Compensation—Compensation — Summary Compensation Table” section of this Proxy Statement, which contains tabular information and narrative discussion about the compensation of our Named Executive Officers and additional details about our executive compensation programs, including information about fiscal

2018year 2020 compensation of our Named Executive Officers. The Compensation Committee and

the NIour Board

of Directors believe that these policies are effective in implementing our compensation philosophy and in achieving its goals.

We are asking our stockholders to indicate their support for our executive compensation as described in this Proxy Statement. This

Say-on-Pay proposal gives our stockholders the opportunity to express their views on our Named Executive Officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the philosophy, policies and practices described in this Proxy Statement. Accordingly, we are asking our stockholders to approve, on an advisory basis, the compensation of the Named Executive Officers, as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and disclosure.

The

Say-on-Pay vote is advisory, and therefore not binding on NI, the Compensation Committee, or our

Board of Directors.Board. However, our Board

of Directors and our Compensation Committee value the opinions of our stockholders and to the extent there is any significant vote against the Named Executive Officer compensation as disclosed in this Proxy Statement, we will consider our stockholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns. The

Say-on-Pay vote is conducted annually, and the next such vote will occur at the

2020 Annual Meeting2022 annual meeting of

Stockholders.stockholders.

Vote Required; Recommendation of

the Board of Directors

The

Approval of NI’s executive compensation program requires the affirmative vote of

the holders of at least a majority of the

votes castoutstanding shares entitled to vote who are present, in person or by proxy, on the

proposal at the Annual Meeting is required to approve NI’s executive compensation program. Abstentions will have the same effect as a vote against this proposal.

NI’S

The Board of Directors unanimously recommends votinga vote “FOR” the approval of NI’SNational Instruments Corporation's Executive Compensation Program, as described in this Proxy Statement.

Exhibit ANATIONAL INSTRUMENTS CORPORATION

1994 EMPLOYEE STOCK PURCHASE PLAN

(as amended by the Board of Directors through January 23, 2019, subject to stockholder approval)